Death claims on insurance keep rising amid pandemic

Published:

2021-09-07 06:35:20 BdST

Update:

2026-02-07 02:41:25 BdST

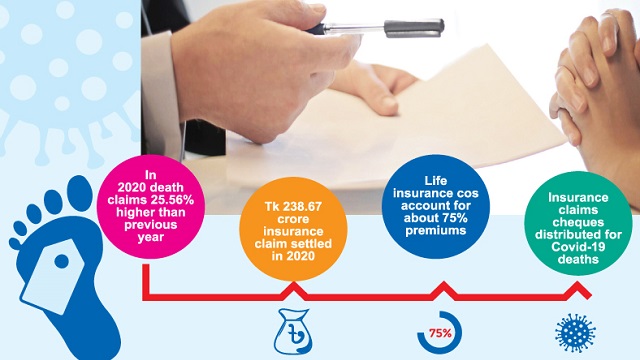

Death claims and settlements on insurance have substantially increased during the coronavirus pandemic period in Bangladesh.

In 2020 death insurance claims of Tk 343.43 crore was 25.56 per cent higher than the previous year -- Tk 280.76 crore. Settlements in the same year amounted to Tk 238.67 crore, up from Tk 190.08 crore, according to the Insurance Development and Regulatory Authority (IDRA).

In 2018, the settlement amount was Tk 178.31 crore against death insurance claims of Tk 271.18 crore. In 2017, the amount was Tk 203.37 crore against death claims of Tk 396.22 crore.

Claim settlement is a crucial element of customer satisfaction that insurers have long neglected. Life insurance companies account for about 75 per cent of the annual premiums collected by insurance companies in Bangladesh.

The remaining 25 per cent belongs to general insurance companies.

IDRA sources said the government launched an initiative marking Father of the Nation Bangabandhu Sheikh Mujibur Rahman’s birth centenary to distribute death claim settlement. Insurance claims cheques have also been distributed under the programme among families of those who died of Covid-19. Under this initiative, insurance companies have settled death claims amounting to around Tk 100 crore so far.

Jiban Bima Corporation Managing Director Md Zahurul Haque told The Business Post that they settled more death insurance claims than other times during the pandemic. Claims of policyholders who died of Covid-19 had also been settled.

“We don’t ignore death claims like other organisations. If someone is eligible to receive a death insurance claim, we pay it on time. Recently we have paid many death insurance claims through Bangabandhu’s Ashar Alo programme,” he added.

The Insurance Act 2010 mandates settling claims within 90 days of maturity of the policy. If the payment is made after 90 days, an additional 5 per cent interest with the bank rate will have to be paid for the additional period.

There are allegations that many insurance companies have ignored the clause for years. The insurance companies’ rates of settlement claims are increasing thanks to IDRA’s steps.

IDRA Director Md Shah Alam told The Business Post that the insurance companies have responded well to the “Bangabandhu Ahsar Alo - Bima Dabi Porishodher Proyash” initiative.

“However, due to the long-term mismanagement of some organisations, there are still some problems in settling claims,” he added.

Md Jalalul Azim, Managing Director and CEO of Pragati Life Insurance, told The Business Post that they had paid around Tk 25 lakh in death settlement during the pandemic.

“Our ‘Hospital Insurance’ policy is quite popular. We have paid a lot more for hospital insurance claims for treatment of Covid-19 than for death claims,” he said. Bangladesh has so far recorded over 1.5 million coronavirus cases and more than 26,000 deaths.

BM Yousuf Ali, managing director and CEO of Popular Life Insurance, said they had paid about Tk 60 lakh against death insurance claims for those who died of Covid-19. They have also settled other death claims.

Saif Rahman, head of communications, MetLife Bangladesh, told The Business Post that they launched a “unique, first-of-its-kind three-hour claims decision service” for Covid-19 death claims of coverages up to Tk 20 lakh.

“It is our latest effort to respond to the pandemic situation in Bangladesh. Under this initiative, the claims decision will be made within three hours and the beneficiaries of deceased policyholders will receive the amount in three working days through Electronic Fund Transfer,” he said.

Sheikh Kabir Hossain, president of the Bangladesh Insurance Association, said the regulatory body, the IDRA, plays a very proactive role in this regard and gives various instructions to each company to settle claims.

“We have also asked the organisations from the association to pay the death claims of Covid-19 victims within two to three working days,” he said.

“We have asked the people concerned to get the documents ready before the claims mature. There is more transparency among insurance companies than ever before, leading to the settlement of more death claims,” he added.

According to insurance companies, claim settlement of life insurance policies increased in 2020 during the pandemic.

Among them, Jiban Bima Corporation’s life insurance claim settlement stood at Tk 46.08 crore, which is Tk 16.01 crore more from the previous year. The insurer settled claims worth Tk 29.57 crore in 2019.

Meanwhile, Pragati Life Insurance Ltd paid Tk 3.40 crore in 2020 in claim settlement, which was Tk 2.90 crore in 2019. NRB Global Insurance paid Tk 28.78 lakh, marking an increase of Tk 22.84 crore from 2019. Metlife Bangladesh paid Tk 1,198 crore in 2020, was Tk 1,084 crore in 2019.

Fareast Islami life Insurance Company paid of Tk 1,228.4 crore in 2020, up from Tk 988.4 crore in 2019. Guardian Life Insurance Company paid Tk 239.1 crore in 2020, up from Tk 171.7 crore in 2019.

Delta life Insurance Company paid Tk 614.2 crore in 2020, up from Tk 600.9 crore in 2019. Diamond Life Insurance Company paid Tk 1.11 crore, which was Tk 80.89 lakh in 2019.

Topic:

Banks asked not to open Nagad account without BB permission

Evaly owes Tk403.80 crore to customers and merchants!

Digital Bangladesh 2021: Payment systems and fintech

Moving the stumbling block for business still a long call

World-class medical equipment Maker 'ANC 'plans to reduce import dependence

Leave your comment here: