Islamic banks are being run in light of Shariah

No negative impact on Islami Bank in Corona

Published:

2021-02-22 16:58:09 BdST

Update:

2025-12-31 18:50:12 BdST

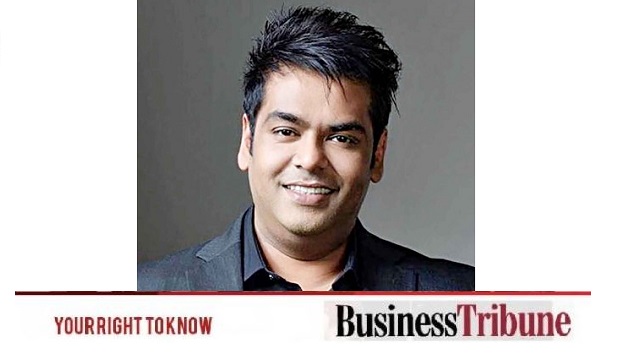

Muhammad Munirul Maula Managing Director (MD) and Chief Executive Officer (CEO) Islami Bank Bangladesh Limited. Prior to that, he was the Additional Managing Director (AMD) of the bank. Muhammad Munirul Maula was the Chairman of the Corporate Investment Wing, Investment (Credit) Committee, Credit Risk Management Committee and Recruitment and Promotion Committee of Islami Bank. He has previously served as the Bank's DMD as Head of the International Banking Wing and Retail Investment Wing. He started his career as a probationary officer in Islami Bank in 1986. A skilled and professional banker with a long experience of 35 years, He has been the head of various branches and zones of the bank and the head of various wings and divisions of the head office.

Educated and trained at home and abroad, Muhammad Munirul Maula obtained his bachelor's and master's degrees in economics from Chittagong University. He is a Diploma Associate at The Institute of Bankers, Bangladesh. He recently received an honorary certificate from the Netherlands-based Factors Chain International (FCI) entitled 'Domestic and International Factoring. He has been regularly participating as a resource person in various professional organizations at national and international level. He has traveled to various countries, including Thailand, Bahrain, Italy, Sri Lanka, the United Arab Emirates, Malaysia, Morocco, Indonesia and Saudi Arabia to attend training and seminars on banking and economics.

BUSINESS TRIBUNE: What do you think is the reason for the expansion of Islamic banking in the country in recent years and the transformation of traditional banks into this trend?

Munirul Maula: Islamic banking system is developing rapidly in the country. It started in 1974 with the participation of Father of the Nation Bangabandhu Sheikh Mujibur Rahman in the Second OIC Conference. The then Finance Minister Tajuddin Ahmed signed the IDB Charter at the OIC Finance Ministers' Conference in Jeddah that year. Following this, Islami Bank Bangladesh started its operations in 1973 as the first generation private bank in the country with the approval of Bangladesh Bank. The Islamic banking system is getting stronger at the national and international level. Islamic banking has gained the trust and confidence of the people through their keen interest and sincere service towards the Shariah-based banking system. The expansion of this system is being accelerated by the management strategy, technology excellence, universality and success. Even during the global financial crisis, the Islamic financial system was not affected. Not just Bangladesh,

BUSINESS TRIBUNE:There is no separate law for Islamic banking system till now. What kind of impact does this have on the activities of the sector?

Munirul Maula: Bangladesh Bank is controlling Islamic banks in the light of 2009 policy. However, separate laws for Islamic banks demand time. Islamic banking has spread individually in each country. Islamic banking has been developed under the auspices of the Malaysian government. They made the law in the beginning. Indeed, a legal environment effectively solves the complexities of the Islamic financial industry and facilitates its development. As there is no Islamic banking law in the country, Shariah-compliant banks are facing complications in resolving disputes under the existing banking system and law. But the hope is that each bank has its own strong Shariah supervisory committee. Islamic banks are being run in the light of Shariah on the basis of well thought out decision of the committee. In addition, the Central Shariah Board for Islamic Banks of Bangladesh is privately overseeing the operation of the banks.

BUSINESS TRIBUNE: The government has recently introduced Sukuk bonds. What will increase the investment potential of Islamic banks?

Munirul Maula: Islamic banks had no instruments other than the government's Islamic Investment Bonds to invest in statutory liquidity preservation (SLR) money. Its rate of return is very low. The government's timely decision to introduce Sukuk. The government has already set up a fund of Tk 4,000 crore to release the bonds. Of this, Islami Bank applied for a bond of Tk 1,500 crore. The bank has received a subscription of Tk 395 crore in the first trench. Conventional banks have also bought 75 per cent units of Sukuk bonds. This proves that people are now leaning more towards Sharia-based economy. Islamic banks have also increased their investment potential through this bond.

BUSINESS TRIBUNE: There is a debate in the country about the profit system of Islamic banking. We see that a rate is fixed in advance just like a conventional bank. How would you explain the matter?

Munirul Maula: Islami Bank accepts current accounts in Al Wadiyah system and all other deposits in Mudaraba system. Islami Bank operates accounts on the basis of Islamic Shariah-compliant Mudaraba agreements executed between banks and account holders. Here the account holder is 'Sahib Al-Maal' i.e. the owner of money and the bank is 'Mudarib' i.e. the organizer of the transaction. The bank accepts the deposit in accordance with the principles laid down in Islamic Shariah and invests the deposited money only in accordance with Shariah. The bank distributes at least 75% of the income earned by investing in Mudaraba funds among the Mudaraba account holders. Profits are shown as a percentage for simple calculations. The estimated rate of profit is determined, which is then adjusted on the basis of profit-loss. According to the country's banking sector, the total investment income is usually not negative. For this reason, the customer does not have to bear the loss in the true sense.

Islami Bank does not trade money. Conducts actual investment activities through the exchange of products in asset-based business management. Islami Bank is fully complying with the Shariah policy by providing business and services on the basis of exchange of goods.

BUSINESS TRIBUNE: As the top bank in the country, how did you handle the Corona epidemic situation?

Munirul Maula: At a time when the global economy has been severely damaged by the Corona epidemic, Bangladesh's economy is turning around again under the visionary and prudent leadership of Prime Minister Sheikh Hasina. Islami Bank is playing an important role as a partner in the country's strong economy and development. The central bank has allocated us the maximum amount of incentive money. The lion's share has already been distributed. The full disbursement of incentives will be completed by March. Corona has not had a negative impact on Islami Bank as a result of conducting business activities with a service mentality. However, about 3,000 of our workers have been affected by the corona and 5 have died while providing services.

BUSINESS TRIBUNE: I would like to know about your plan to adapt to the changed situation.

Munirul Maula: Islami Bank has launched a new app called Selfin to keep customers connected with the bank. You can open a bank account without going to the branch and you will find various banking services including instant visa card in this app. In addition, with an emphasis on alternative banking services, Islami Bank has set targets for debit and credit (Khidmah) card distribution, i-banking and Selfin app customers. Expansion of alternative services, introduction of investment through agent banking, expansion of microfinance, encouragement of small and medium enterprises are among the priorities of Islami Bank.

Although you are a pioneer, many banks are now coming to Islamic banking. How is this affecting your business?

Munirul Maula: Islami Bank is the largest and strongest bank in the country. Promoter of Shariah-based banking system in Bangladesh. At present the amount of deposit is one lakh 19 thousand crore rupees. The amount of general investment is one lakh 4 thousand crore rupees. The number of subscribers has increased to one crore 59 lakhs. At present we are providing services through 363 branches, 16 sub-branches, 2300 agent outlets, 1896 ATMs or CRM booths. Bangladesh is the only bank in the list of 1000 best banks in the world. It has also won the award of the best Islamic bank in the world. In such a situation, the other bank's involvement in Islamic banking activities is not a rival for us; Rather they are our allies. The goal of Islami Bank is to expand the welfare oriented banking system.

BUSINESS TRIBUNE: Tell us about the problems and possibilities of Islamic banking in Bangladesh.

Munirul Maula: Islamic banking is a very promising sector in the country. Many old and new banks want to come to Islamic banking. Large sections of the population are still out of banking services, which can be incorporated into Islamic banking. Significant challenges of Islamic banking are the absence of Islamic banking laws in the country. Inadequate education, research and training on Shariah-based banking and finance are needed. There is a dearth of knowledgeable, experienced and skilled bankers and officials in the field of Islamic financing and Shariah-compliant outline of transactions.

BUSINESS TRIBUNE: What kind of initiatives are needed to spread Islamic banking?

Munirul Maula: Islamic money market and bond market need to be made more dynamic for the expansion of Islamic banking. Islamic banking supportive educational activities, research and supportive institutions should be increased. In addition, international standard institutions need to be created for training.

Topic:

Kamal Quadir: The artist who became a fintech guru

Newcomer heroine Priyo Moni spreads warmth

"A market leader must behave like a leader"

Think about customers’ needs to succeed in the long run

Meghna Bank plans transformation and to build strong customer base

Leave your comment here: